Truth in Taxation meeting allows taxpayers to share opinions and ask questions

Each year, counties are required by state statute to hold a Truth in Taxation meeting during which members of the public can ask questions about and comment on the proposed budget for the following year.

On Dec. 2, Cook County’s Truth in Taxation meeting took place at the courthouse. Auditor-Treasurer Braidy Powers presented the proposed budget to the members of the public in attendance. Earlier this year the Board of Commissioners approved a 7.57% levy increase. At the Truth in Taxation meeting Powers said that that proposed levy increase has decreased to 6.79%, based on adjustments made in different departments since the proposed levy was passed.

In his presentation, Powers highlighted the proposed changes for 2026 compared to the final 2025 budget.

Powers also explained what some of the budget drivers for this next year were. Among those items was an 11.8% increase in health insurance costs. Powers said that increases in other counties were much higher than in Cook County, but that it was still up from 2025, when the increase in price was 9.95%. On the staffing expenses front, employees will also see a 2.75% cost of living adjustment to their pay.

This past year the county issued two sets of bonds. One was to help cover the cost of the transfer station project. The county bond cost for that project will be paid by a solid waste fee assessed on all taxable parcels in 2026. The county also issued jail bonds to contribute to the Law Enforcement Center expansion. Payment on those bonds will come from the regular county tax levy.

Another longer-term change the county has factored into the budget is a decrease in the amount of money from Payment in Lieu of Taxes (PILT) for the Boundary Waters Canoe Area Wilderness. The BWCAW will be assessed again in 2028, but at this time the county receives about $400,000 less than it did based on previous assessment.

Though there are several factors that are creating a tight budget, Powers said that the county’s fund balance has benefited from strong interest rates in their investment accounts. Interest rates are beginning to decline, but only after several years of consistently high rates.

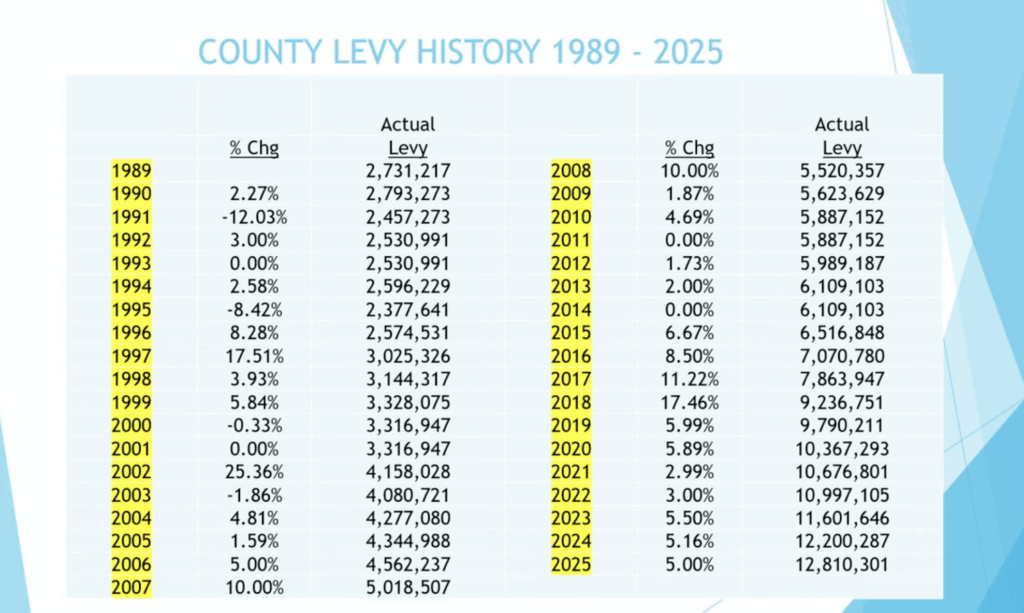

The exact levy increase changes every year. Over the past 35 years, the levy amount has fluctuated widely, with some years showing a decrease, and others up to a 25% increase. Powers said that the average increase since 1989 is 4.39%. He added, “One of the goals for the board is to try to keep a stable levy and avoid all of those ups and downs.

After the presentation, the public was able to ask questions or make comments about the budget.

“It’s a lot of money,” said Jon Mathisrud, a member of the public in attendance. “But you can’t hold it down. The costs are just amazing today.”

Another member of the public asked about how state and federal funding changes have impacted the local budget. “We’re still bracing for a lot of depletion in some of the areas, especially Public Health and Human Services and our Highway Department” said Commissiner Ginny Storlie. “We’re still in the kind of awkward stage where we’re not sure what is going to happen.”

“The pain is going to happen in 2027,” Commissioner Dave Mills said. “We’re bracing and trying to be as conservative as we can.”

Administrator Kristen Trebil-Halbersma said that the county is keeping a specific eye on funding for public health and human services programs. She said they are monitoring potential changes closely.

There is just one meeting remaining in 2025, and the board will be required to pass a final budget before the end of the year. The board plans to finalize the budget on Dec. 16, but could hold a special meeting if they are unable to.